As client demand for portfolio diversification grows, advisors are increasingly turning to alternative investments to enhance returns, reduce volatility, and improve long-term outcomes. But for many wealth managers and RIAs, the question remains: what are alternative funds, and how can they be effectively incorporated into a modern model portfolio?

This guide introduces the concept of alternative assets and offers practical strategies for integrating them across client risk profiles and objectives, while highlighting how FINIQ Alternatives Market provides the tools, structure, and support to simplify the process.

Explore FINIQ Alternatives Market

Understanding Alternative Funds and Structures

Alternative funds encompass a broad range of strategies beyond traditional stocks and bonds, including private equity, venture capital, private credit, real estate, hedge funds, and infrastructure. These strategies provide non-correlated return streams and can complement traditional asset classes when constructing well-diversified portfolios.

These funds are often structured as limited partnerships or private offerings and may carry restrictions on liquidity, valuation frequency, and investment minimums.

Unlike traditional ETFs or mutual funds, alternative funds are designed to offer exposure to non-correlated assets and differentiated return streams. They can play a vital role in addressing inflation, interest rate sensitivity, and market volatility.

Optimal Allocation Guidance for Alternative Investments

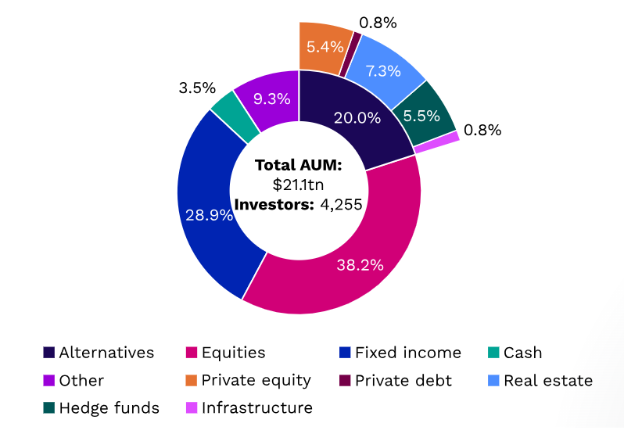

Preqin’s 2024 Institutional Allocation Study reports that the average institutional investor has increased their allocation to alternatives from approximately 18.4% to 20% over the past five years. Preqin data also highlights that nearly 50% of family offices and wealth managers allocate significant portions of their portfolios to alternatives.

Source: Preqin 2024

Benefits and Risks of Alternative Investments

While alternative investments offer unique advantages, they also come with specific risks. Understanding both is key to constructing balanced, goal-aligned model portfolios.

Benefits:

- Portfolio diversification through low correlation with traditional markets

- Potential for higher risk-adjusted returns

- Income generation through real estate and credit strategies

- Access to private market growth, not available in public markets

Risks:

- Limited liquidity and long lock-up periods

- Higher due diligence and monitoring requirements

- Complex fee structures depending on the platform or manager

- Valuation and transparency challenges, especially in non-marketable assets

Given this context, RIAs designing model portfolios often set alternative exposure targets in the 15%–25% range, balancing diversification benefits with client liquidity and risk tolerance.

Model portfolios that incorporate alternatives enable advisors to design consistent, repeatable strategies that align with client objectives. FINIQ Alternatives Market supports this effort with curated access to high-quality funds that complement traditional allocations.

Selecting the Right Fund Strategy

Allocating to alternatives isn’t one-size-fits-all. Advisors must align fund strategies with the client’s timeline, liquidity needs, and risk tolerance. For example:

- Private equity and growth equity are ideal for clients with long-term horizons seeking capital appreciation.

- Private credit offers attractive yield with lower volatility and is often suitable for income-oriented investors.

- Real estate can serve as both an inflation hedge and an income stream.

- Venture capital provides early-stage exposure with higher return potential—but with increased risk.

- Hedge funds offer flexible strategies that can generate returns in various market conditions, often appealing to investors seeking diversification and downside protection.

FINIQ Alternatives Market helps advisors match strategies to portfolio objectives while offering the ability to customize minimums and allocations based on client needs.

FINIQ Alternatives Market Tools and Resources to Support Portfolio Design

FINIQ Alternatives Market is an alternative investment marketplace that was purpose-built to support financial professionals integrating alternatives into model portfolios. Unlike iCapital and CAIS, which operate primarily through feeder fund structures and charge access fees, FINIQ offers direct access to alternative funds with no platform access fees and full fund transparency.

FINIQ Alternatives Market offers:

- Free platform access

- Direct access to Alternative Investments with lower investment minimums

- End-to-end subscription processing

- Internal and third-party due diligence

- Compliance-ready fund materials

- Portfolio modeling assistance through in-house experts

Learn More About FINIQ Alternatives Market

Unlock Direct Access to Alternative Investments with FINIQ

Incorporating alternative funds into model portfolios is no longer a luxury for ultra-high-net-worth clients. It is a practical, scalable strategy for RIAs seeking to differentiate, retain, and deliver long-term value to their clients.

FINIQ provides the access, education, and tools wealth managers need to succeed in a complex market, without the layers of cost and complexity found on traditional platforms like iCapital, CAIS, or Yieldstreet.

Explore FINIQ Alternatives Market and see how we’re helping advisors build better portfolios.

References

Preqin – https://www.preqin.com/insights/research/reports/institutional-allocation-study-2024?

FINIQ – https://finiq.vip/the-ultimate-guide-to-alternative-investments-for-financial-advisors/

Disclaimer: The FINIQ Alternatives Marketplace is intended for use by financial professionals only. Access is restricted to registered investment advisors, broker-dealers, and other qualified institutional investors.