Record transaction volumes, shifting allocator sentiment, and rising liquidity needs are reshaping the private market landscape.

The secondary market is in the midst of a historic expansion. Global secondary transaction volume reached an all-time high of $162 billion in 2024, up from the previous record of $132 billion set in 2021, according to Jefferies. LP-led transactions made up the majority of the activity, totaling $87 billion, with first-time sellers representing approximately 40% of that volume.

That trend appears poised to continue in 2025. Market participants report a growing number of limited partners—particularly pensions, endowments, and foundations—coming to market for the first time, driven by the need for liquidity, portfolio rebalancing, and vintage diversification.

From Stigma to Strategy

Historically, many institutions viewed secondary sales as distress-driven. That perception is changing rapidly. Recent high-profile transactions include:

- Yale University’s $2.5 billion sale of private equity and venture capital holdings

- New York City’s $5 billion sale of PE assets to Blackstone Strategic Partners

Both were first-time secondary sellers. These moves signal that large, sophisticated allocators are increasingly treating secondary markets as standard portfolio management tools—not just fallback options.

The motivation is clear. Distributions from private funds have slowed sharply after four consecutive years of declining exit activity. At the same time, many LPs face fixed capital commitments and limited flexibility to reallocate without generating liquidity elsewhere in the portfolio.

No Longer the Exception

A growing number of allocators are deciding not to wait for fund managers to generate liquidity. According to industry advisors, peer influence is also playing a role—institutions are more likely to test the secondary market after seeing their peers do the same.

Despite the influx of new sellers, pricing remains firm. Buyers have significant dry powder and remain selective, focusing on high-quality assets with visible NAVs and strong GP sponsors. According to PitchBook, fundraising for secondary funds increased by 51.6% year-over-year through Q1 2025, even as broader PE fundraising declined.

The supply of assets is increasing, but market participants say this has not meaningfully diluted pricing power or asset quality.

First-Time Sellers Are Gaining Confidence

While repeat sellers still account for the majority of deal flow, the volume of inquiries and listings from first-time sellers is rising. Several legal and advisory firms report a healthy pipeline of pending portfolios from both new and returning clients.

However, the proportion of first-time sellers may not change dramatically by year-end—simply because overall deal volume is expanding so rapidly.

Still, the broader trend is clear: the secondary market is no longer an exclusive domain for distressed sellers or liquidity-challenged firms. It is now a mainstream mechanism for portfolio optimization, strategic exits, and reallocation.

How FINIQ Enables LP Liquidity Through Pre-IPO Secondaries

FINIQ provides institutional access to secondary shares of late-stage private companies through the FINIQ Institutional Dark Pool. For LPs seeking targeted liquidity, portfolio diversification, or exposure to innovation-stage assets, FINIQ offers a transparent and efficient platform connecting buyers and sellers in the secondary private securities market.

- Direct access to institutional-quality Pre-IPO shares

- Transaction support and third-party due diligence

- Streamlined execution and transparent pricing

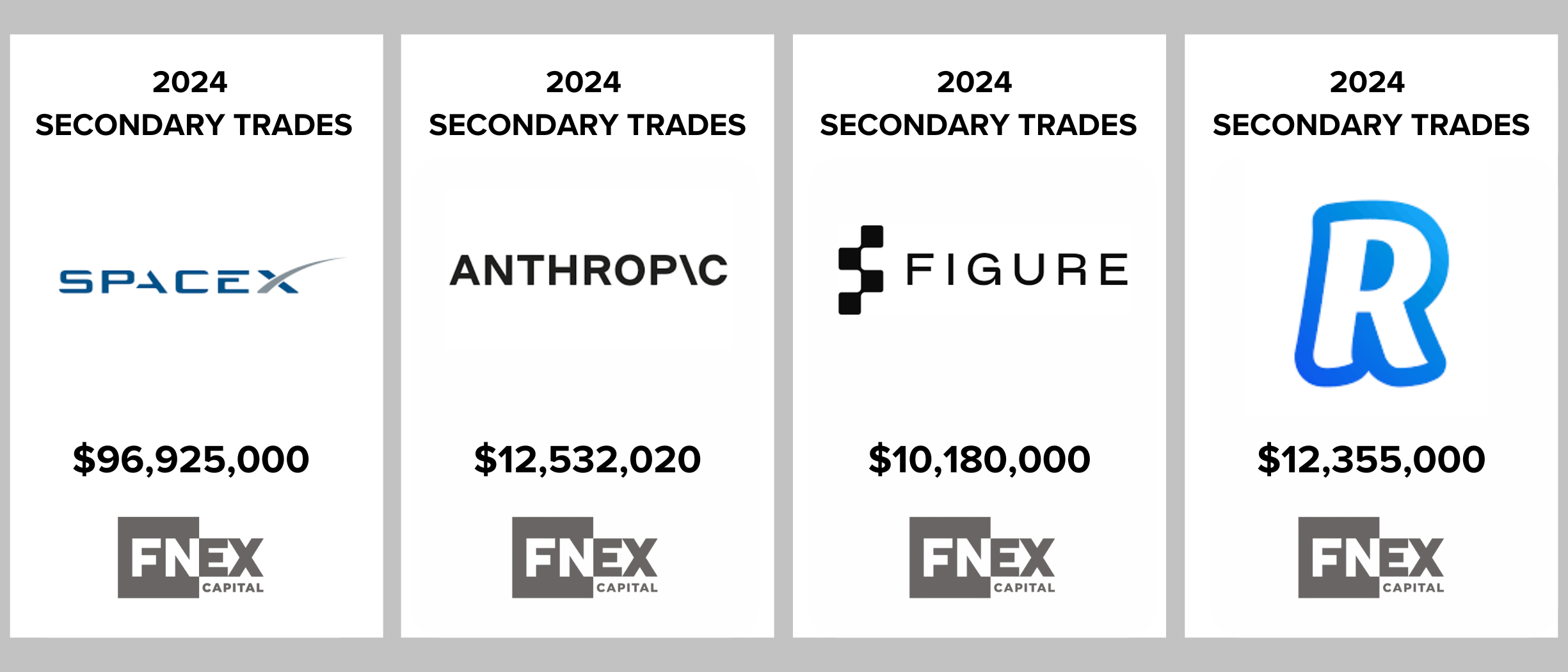

At FINIQ, we lead the industry in delivering secure, streamlined transactions in this pre-IPO secondary market. With over $15 billion in private securities transactions, our recent activity includes secondary market transactions in SpaceX stock, OpenAI stock, and Databricks stock, providing institutional investors with access to some of the most competitive opportunities in the pre-IPO landscape.

Explore Pre-IPO Liquidity Solutions with FINIQ

CONTACT US TODAYReference

PitchBook – https://pitchbook.com/news/articles/are-more-lps-debuting-on-the-secondary-market-than-ever

FINIQ – www/investment-banking/pre-ipo-stock/