Figma, the collaborative design platform known for transforming how digital products are built, has officially filed for an initial public offering (IPO) with the U.S. Securities and Exchange Commission (SEC). According to the company’s press release, the registration statement on Form S-1 relates to a proposed public listing of its Class A common stock, which is expected to trade on the New York Stock Exchange under the ticker symbol “FIG.”

While the number of shares and pricing details remain undisclosed, the offering will be led by a strong syndicate of underwriters. Morgan Stanley, Goldman Sachs & Co. LLC, Allen & Company LLC, and J.P. Morgan will act as joint lead book-running managers. They are joined by BofA Securities, Wells Fargo Securities, and RBC Capital Markets as additional bookrunners, with William Blair and Wolfe | Nomura Alliance serving as co-managers.

A Long-Anticipated Market Debut

Figma’s public filing marks a significant milestone for the company, which has become a cornerstone tool for product designers, developers, and teams seeking real-time collaboration in a remote-first world. Founded in 2012, Figma was originally positioned as a web-based design tool but has since evolved into a comprehensive platform that leverages AI and cloud-based infrastructure to streamline product development from concept to launch.

“Figma is where teams come together to turn ideas into the world’s best digital products and experiences,” the company stated in its release, reinforcing its vision to go beyond design and empower connected product teams.

Regulatory Hurdles Behind, Growth Ahead

The IPO news comes less than a year after Figma’s proposed $20 billion acquisition by Adobe was blocked by regulators, citing antitrust concerns. While the failed merger created uncertainty in 2023, Figma appears to have emerged stronger, with its IPO signaling renewed momentum and independent growth ambitions.

Despite the fanfare surrounding the announcement, Figma cautioned that the offering is subject to market conditions and that there is no guarantee as to when—or if—it will be completed, nor the eventual pricing or offering size.

Strategic Timing in a Shifting IPO Market

Figma’s IPO filing arrives as investor appetite for tech IPOs cautiously reopens after a long lull. While 2022 and 2023 saw a dramatic slowdown in public offerings, several high-profile tech firms are now testing the waters again. Figma’s ability to differentiate itself as both a SaaS platform and a critical productivity tool could make it especially attractive to public investors seeking scalable, collaborative, AI-enabled solutions.

As part of the process, the offering will only be made via a formal prospectus, and the SEC has not yet declared the Form S-1 effective.

Final Thought

Figma’s proposed IPO is more than just a financial event—it signals the next chapter for one of the most innovative platforms in the product design and collaboration space. With a loyal user base, a robust ecosystem, and growing enterprise traction, Figma is poised to capitalize on its public debut, pending favorable market conditions. All eyes will now be on “FIG” as Wall Street waits for the next design-driven tech success story to unfold.

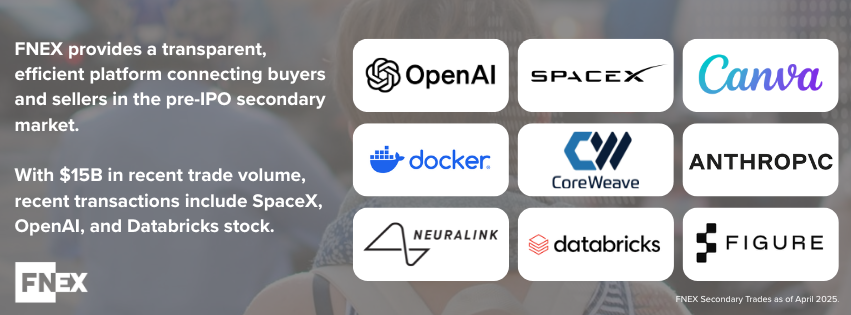

Unlock Access to Private Securities with FINIQ

FINIQ offers institutional investors direct access to a secondary marketplace of pre-IPO private securities, connecting buyers and sellers across the private market with speed and transparency. FINIQ provides exclusive access to late-stage opportunities, supported by proprietary trade data and market insights to enhance decision-making in the private securities space.

LEARN MORE ABOUT FINIQ PRE-IPO MARKET

Contact FINIQ today to gain an edge in the evolving pre-IPO secondary market.

References

1. Tech In Asia: https://www.techinasia.com/news/figma-ipo-warms-up-slowed-tech-market

2.

Business Insider: https://www.businessinsider.com/figma-ipo-investors-better-outcome-adobe-deal-2025-7

Disclaimer: This material does not constitute tax, legal, insurance or investment advice, nor does it constitute a solicitation or an offer to buy or sell any security or other financial instrument. Securities offered through FINIQ Capital, member FINRA, SIPC. The FINIQ Pre-IPO Marketplace is intended for use by financial professionals only. Acce