Kraken, a leading global cryptocurrency exchange, is reportedly seeking to raise $500 million in a new funding round at a $15 billion valuation, according to a Reuters report citing The Information. The raise would significantly bolster Kraken’s balance sheet ahead of a public listing expected in early 2026.

Kraken Positioned for Public Markets

Kraken’s reported $500 million raise signals growing investor confidence in the company’s trajectory and may represent one of its final private rounds before entering the public markets. A successful funding round at the projected $15 billion valuation would solidify Kraken’s position as a top-tier exchange ahead of its 2026 IPO.

The company previously achieved unicorn status in 2021 and has since maintained momentum amid volatile crypto market cycles. Kraken’s diversified user base, ranging from retail investors to institutions, has fueled steady platform growth and engagement.

Strategic Expansion in the European Union

In addition to its funding efforts, Kraken recently secured regulatory approval to operate under the European Union’s Markets in Crypto-Assets (MiCA) framework. This approval opens the door to compliant expansion across EU member states and provides another key growth avenue.

The MiCA framework establishes consistent crypto regulations across Europe, making Kraken’s compliance an important milestone in its global strategy. It also demonstrates Kraken’s ability to align with evolving regulatory standards, a critical factor as it prepares for the scrutiny of public markets.

A Decentralized Future, One Trade at a Time

Kraken’s infrastructure, investor support, and regulatory readiness put it in a strong position to capitalize on rising global interest in digital assets. As the company sets its sights on going public, its mission remains rooted in building a more open and decentralized financial system, one trade at a time.

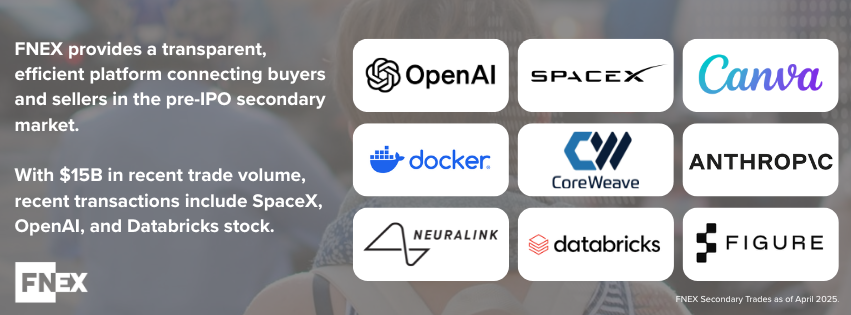

Unlock Access to Private Securities with FINIQ

FINIQ offers institutional investors direct access to a secondary marketplace of pre-IPO private securities, connecting buyers and sellers across the private market with speed and transparency. FINIQ provides exclusive access to late-stage opportunities, supported by proprietary trade data and market insights to enhance decision-making in the private securities space.

LEARN MORE ABOUT FINIQ PRE-IPO MARKET

Contact FINIQ today to gain an edge in the evolving pre-IPO secondary market.

Reference

Disclaimer: This material does not constitute tax, legal, insurance or investment advice, nor does it constitute a solicitation or an offer to buy or sell any security or other financial instrument. Securities offered through FINIQ Capital, member FINRA, SIPC. The FINIQ Pre-IPO Marketplace is intended for use by financial professionals only. Access is restricted to registered investment advisors, broker-dealers, and other qualified institutional investors.