From Open-Source AI to Desktop Robots: Hugging Face Enters a New Market

Hugging Face, best known for powering much of the open-source AI ecosystem, has entered the consumer robotics space and it’s off to a fast start. Just five days after opening preorders for its new desktop robot, Reachy Mini, the company reported $1 million in sales. This signals strong early interest and positions Hugging Face at the forefront of a growing market that blends AI, robotics, and consumer technology.

While many robotics startups aim to build high-functionality humanoid assistants for tasks like home cleaning or elder care, Hugging Face is pursuing a different strategy. The Reachy Mini is a compact, hackable robot designed more for exploration, learning, and experimentation than for chore delegation. It reflects a larger vision of bringing AI-powered robotics into the hands of developers, students, and hobbyists as an accessible and programmable tool.

An “Empty iPhone” for AI-Driven Robotics

Co-founder and Chief Scientist Thomas Wolf compares the Reachy Mini to “an empty iPhone,” emphasizing its potential as a platform rather than a standalone gadget. The robot features expressive, camera-equipped eyes, microphones, speakers, and antenna-like ears. It ships with basic functionality, but its true value lies in the ability for users to build and install custom apps through open-source software that runs locally.

This model, selling the hardware and enabling a third-party app ecosystem, could unlock a new business line for Hugging Face while aligning with its open-source philosophy. If successful, it would mirror the evolution seen in smartphones, where hardware sales become the entry point for recurring software engagement.

Positioning for Long-Term Ecosystem Growth

The launch of Reachy Mini follows Hugging Face’s acquisition of French robotics startup Pollen and reflects a long-term strategy to fuse open-source AI models with physical machines. In an interview on the Equity podcast, Wolf emphasized that affordability and accessibility were key design principles. The team deliberately priced Reachy Mini within reach of consumers and educators, removing the barrier to entry and increasing exposure to everyday AI applications.

What sets this strategy apart is Hugging Face’s bet on community-led innovation. By encouraging developers to build their own apps and functionality, the company is planting seeds for a broader robotics ecosystem. For investors, it raises a compelling question: Could consumer robotics follow the same trajectory as smartphones and personal computing?

Why It Matters for Private Markets

For allocators and venture capitalists watching the next wave of AI applications, Hugging Face’s approach signals a major shift. The company is not just advancing machine learning in the cloud; it is bringing it to the edge, into physical form. That has implications across industrial automation, education, entertainment, and long-term human-machine interaction.

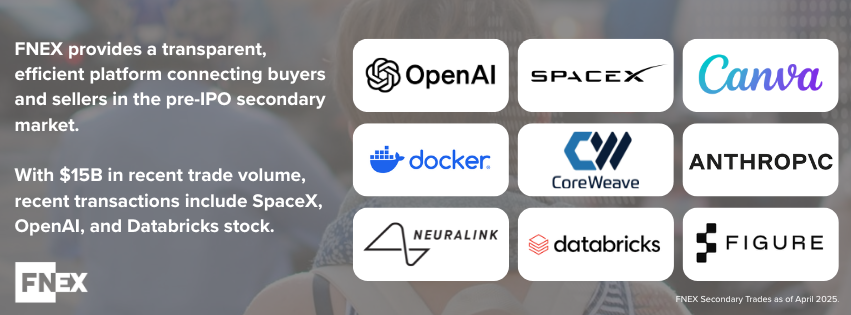

Unlock Access to Private Securities with FINIQ

FINIQ offers institutional investors direct access to a secondary marketplace of pre-IPO private securities, connecting buyers and sellers across the private market with speed and transparency. FINIQ provides exclusive access to late-stage opportunities, supported by proprietary trade data and market insights to enhance decision-making in the private securities space.

LEARN MORE ABOUT FINIQ PRE-IPO MARKET

Contact FINIQ today to gain an edge in the evolving pre-IPO secondary market.

Reference

Tech Crunch – https://techcrunch.com/podcast/hugging-face-bets-on-cute-robots-to-bring-open-source-ai-to-life/

Disclaimer: This material does not constitute tax, legal, insurance or investment advice, nor does it constitute a solicitation or an offer to buy or sell any security or other financial instrument. Securities offered through FINIQ Capital, member FINRA, SIPC. The FINIQ Pre-IPO Marketplace is intended for use by financial professionals only. Access is restricted to registered investment advisors, broker-dealers, and other qualified institutional investors.