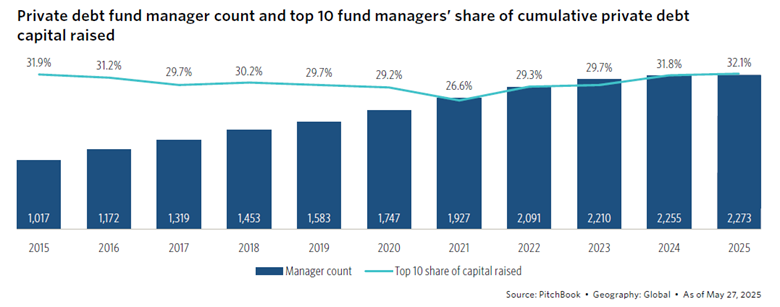

Private debt is having a record-setting year. According to PitchBook, the top 10 private debt managers are on pace to raise 33% of all global capital in 2025. The consolidation of the asset class, fueled by mega fund closes from managers like Ares and Brookfield/Oaktree, marks a turning point: private debt is no longer niche. It’s mainstream.

Yet access remains a challenge for RIAs, financial advisors, and smaller institutions. That’s where FNEX Alternatives Market offers a distinct advantage in the alternative investments landscape.

Explore FINIQ Alternatives Market

The Institutionalization of Private Credit and Alternative Investments

From 2014 to 2023, global assets under management (AUM) in private debt grew from $557 billion to over $2 trillion. As traditional banks retreat from middle-market lending, alternative investment managers are filling the void and growing rapidly.

Source: PitchBook 2025 US Private Equity Outlook Midyear Update

PitchBook notes that limited partners are increasingly consolidating general partner relationships, prioritizing established managers with scale and infrastructure. But while large allocators gain easier access to alternative investments, independent advisors and smaller firms risk being left out of the private credit opportunity.

FINIQ Alternatives Market Makes Private Debt and Alts Accessible

FINIQ Alternatives Market investment platform solves this problem by connecting RIAs, wealth managers, and institutional investors with a curated suite of private credit and other alternative investment strategies. As a private market technology solution, the platform is designed to meet the unique needs of wealth management alternative investments. These funds are screened for quality, structured for accessibility, and supported with full transparency, including integrated fund administration for alternatives.

What FINIQ Alternatives Market offers:

- Direct access to direct lending, opportunistic credit, and distressed private debt strategies.

- A broad range of alternative investments, including private equity, venture capital, and real assets.

- Fund structures with lower minimums which makes it ideal for advisors looking to serve HNW clients.

- Integrated reporting, regulatory compliance support, and investor communication tools.

Learn More About FINIQ Alternatives Market

Empowering Advisors to Compete in the 2025 Private Markets

In a world where yield remains elusive and market volatility is rising, private credit offers attractive risk-adjusted returns. As a key pillar of a diversified alternatives portfolio, private debt is becoming essential to modern asset allocation.

Through the FINIQ Alternatives Market, financial advisors and wealth professionals gain the ability to compete with institutions by offering direct access to high-quality alternative investments with no platform access fee.

Explore the FINIQ Alternatives Market to access private credit and more in 2025.

References