As IPO activity declines and companies remain private longer, investors are moving upstream to capture value earlier. Private securities are emerging as a core allocation for institutions and accredited investors seeking access to innovation, growth, and returns not available in public markets.

Companies are delaying public listings, private equity-backed firms dominate across sectors, and capital is concentrating in the private domain.

Fewer IPOs and Older Companies Going Public

Since 2000, the average number of IPOs per year has dropped to 125, compared to more than 300 in the 1990s. At the same time, the median company age at IPO has increased to over 11 years. The value creation that used to occur post-IPO now takes place privately, often long before public market access begins.

Most Growth Companies Are Now Private

The private market is no longer a side segment. There are now more than 11,000 PE-backed private companies in the U.S., compared to fewer than 5,000 public companies.

Revenue data reinforces this shift:

- 86% of U.S. companies with over $100 million in revenue are private

- Even among $1 billion revenue companies, private companies outnumber public ones

Investors who rely solely on public markets are missing a majority of high-growth opportunities.

Private Markets Lead in Innovation and Sector Reach

Private equity-backed companies dominate in technology, healthcare, business services, and financials. They also outnumber public companies in every major geography. In the U.S., there are nearly 8 private companies for every one public company

LEARN MORE ABOUT FINIQ PRE-IPO MARKET

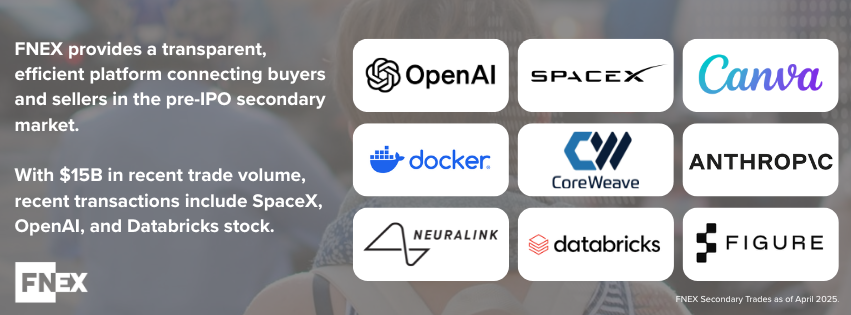

Private securities are essential for modern portfolios. As companies stay private longer and the public market shrinks in relative value, investors need a platform that can unlock deal flow at scale.

FINIQ delivers the access, infrastructure, and support required to participate in the private securities market with confidence.

References

- McKinsey & Company, The Future of Private Markets, 2023

- PitchBook, Private Market Performance Update, Q1 2024

- Preqin, Global Alternatives Report, 2024

- FINIQ Pre-IPO Stock – https://finiq.vip/investment-banking/pre-ipo-stock/

Disclaimer: The FINIQ Pre-IPO Marketplace is available exclusively to institutional and accredited investors.