Revolut is preparing to enter the competitive rewards credit card market, positioning itself against industry giants like American Express and Barclaycard. The UK-based fintech, which has surpassed 50 million customers globally, is in the early stages of developing a credit card that will operate on its proprietary loyalty currency, RevPoints.

Revolut’s New Product

Initially launched in July 2023, RevPoints allows Revolut users to earn points through debit card purchases. The company now plans to expand the program across a full suite of credit cards tailored to each of its subscription tiers. This move could significantly strengthen Revolut’s product ecosystem and loyalty strategy as it seeks to deepen user engagement.

Revolut’s approach may focus on broader redemption flexibility. RevPoints can already be redeemed for major gift cards, including Apple and Amazon, and are exchangeable on a 1:1 basis with several popular airline mile programs. This versatility could provide a compelling alternative to loyalty systems tied to limited ecosystems.

The credit card project is part of a wider diversification strategy. In January, Revolut revealed it was developing a private banking service targeting high-net-worth individuals (HNWIs), complete with wealth and investment advisory offerings. The company is also expected to roll out an AI-powered financial assistant and a mortgage product in 2025.

Looking Ahead

Revolut’s expansion into traditional legacy financial services – from credit cards and mortgages to private banking, reflects a maturing roadmap as the company moves beyond its roots in currency exchange and digital banking. With infrastructure and brand recognition now in place, Revolut is positioning itself as a comprehensive financial platform ready to challenge legacy players across multiple verticals.

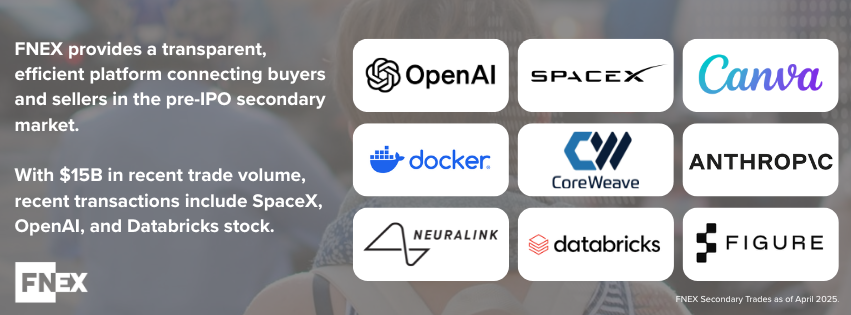

Access Pre-IPO Shares in the Private Market with FINIQ

FINIQ offers institutional investors direct access to a secondary marketplace of pre-IPO private securities, connecting buyers and sellers across the private market with speed and transparency. FINIQ provides exclusive access to late-stage opportunities, supported by proprietary trade data and market insights to enhance decision-making in the private securities space.

LEARN MORE ABOUT FINIQ PRE-IPO MARKET

Contact FINIQ today to gain an edge in the evolving pre-IPO secondary market.

Reference

Sifted – https://sifted.eu/articles/revolut-reward-credit-cards

FINIQ strives to be a thought leader in the private market. Follow us on LinkedIn for alerts on the latest market insights: https://www.linkedin.com/company/fnex/.

Disclaimer: This material does not constitute tax, legal, insurance or investment advice, nor does it constitute a solicitation or an offer to buy or sell any security or other financial instrument. Securities offered through FINIQ Capital, member FINRA, SIPC.