Institutional portfolios are being reshaped by a powerful force: the accelerated maturation of private markets. With IPOs delayed, public market opportunities thinning, and innovation increasingly housed in private firms, allocators are shifting capital toward pre-IPO secondary investments to stay competitive.

Structural Drivers of the Shift

1. The De-Publicization of Growth

Companies today are staying private longer than ever before. The number of publicly listed companies in the U.S. has declined by more than 40% since 1999, despite a significant increase in overall market capitalization. As a result, value creation is now concentrated in the private markets—not public exchanges.

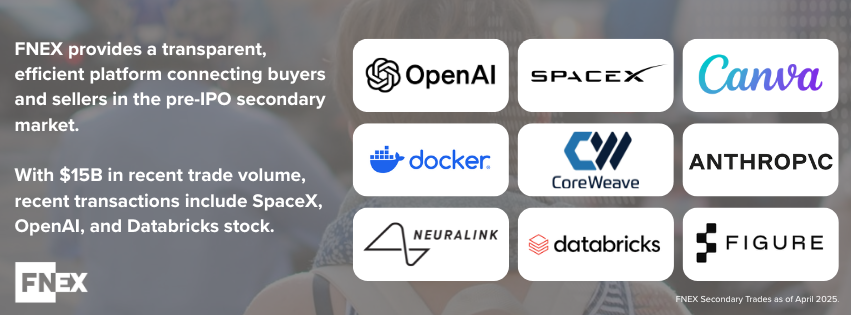

Companies like OpenAI, SpaceX, Stripe, and Epic Games have achieved multi-billion-dollar valuations while remaining private. This shift challenges the traditional view that meaningful growth only occurs after an IPO. Today’s high-growth companies are accruing more value before going public, limiting access for traditional public equity investors.

2. Private Market Return Asymmetry

Pre-IPO allocations allow institutions to invest in companies at a late stage, after much of the early-stage risk has been mitigated, but before liquidity events unlock valuation premiums. These deals often have:

- Shorter duration to exit (1–3 years)

- Stronger financials and revenue visibility

- Established cap tables with clear governance

3. Innovation Is Going Private First

The frontier of innovation is being defined by private companies. From generative AI to aerospace, healthtech, and data infrastructure, the most dynamic sectors are led by private firms with lean operations and long-term capital support.

Institutions that fail to secure exposure to these markets risk missing the next decade of market-defining growth.

FINIQ: Your Pre-IPO Access Partner

FINIQ’s Institutional Dark Pool is built specifically for accredited and institutional investors looking to transact in large blocks of pre-IPO shares. We bring liquidity, transparency, and a direct connection to both primary stakeholders and active sellers.

Our proprietary platform provides access to private securities, ensures due diligence, compliance alignment, and seamless execution in an otherwise fragmented market.

LEARN MORE ABOUT FINIQ PRE-IPO MARKET

Contact us today to explore how you can gain access to our pre-IPO marketplace.

Reference

- McKinsey & Company. “Private Markets Rally to New Heights.” 2023

- E&Y – https://www.ey.com/en_us/insights/ipo/q4-2023-ipo-market-trends

- FINIQ – https://finiq.vip/investment-banking/pre-ipo-stock/

Disclaimer: This material does not constitute tax, legal, insurance or investment advice, nor does it constitute a solicitation or an offer to buy or sell any security or other financial instrument. Securities offered through FINIQ Capital, member FINRA, SIPC. The FINIQ Pre-IPO Marketplace is intended for use by financial professionals only. Access is restricted to registered investment advisors, broker-dealers, and other qualified institutional investors.